Connect with your communities

No matter your goals, we meet you where you are. Keep up with the complex needs of your communities more effectively now and lay the groundwork for innovation in the future.

Digitization

Use automation to optimize existing processes and digitize manual steps. Work faster and more effectively with integrated solutions that minimize human error.

Modernization

Modernize legacy systems without compromising mission integrity. Simplify payments, reduce costs, and leverage innovative technology like blockchain to prepare for complex constituent needs.

Scalability

Connect with local and global communities. JPMorgan Chase is the first bank in the US with branches in all 50 states. And with banks across the world, we’re with you wherever your mission takes you.

How we can help

Whether your agency is building an agile financial foundation or exploring blockchain, we meet you where you are with products and solutions powered by advanced security, data-driven insights and expertise.

Collections and disbursements

From integrated payables to lockbox solutions, we help seamlessly manage incoming and outgoing payments with solutions at the forefront of innovation.

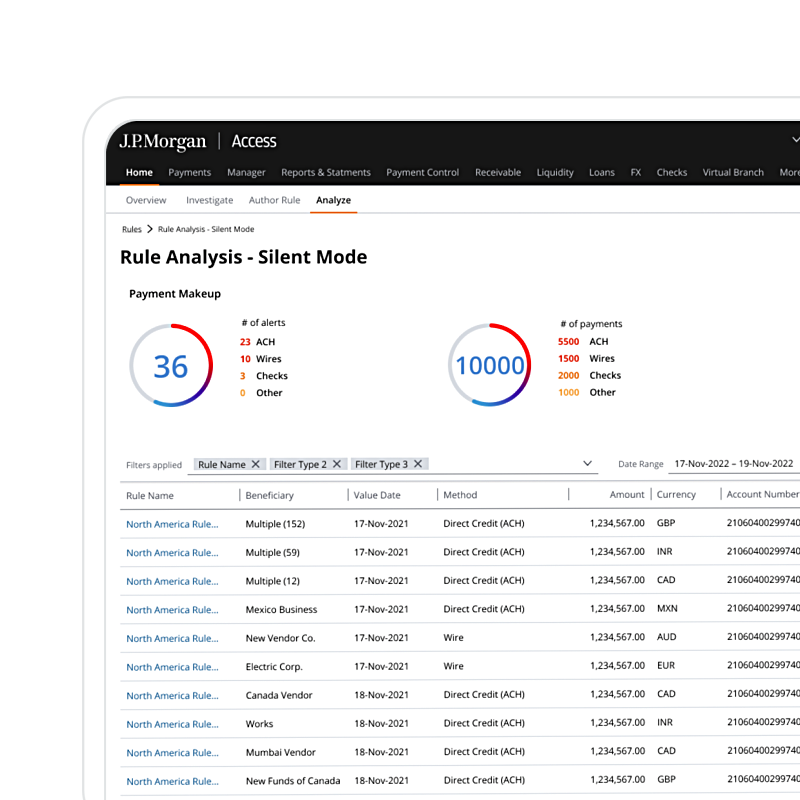

Fraud and risk management

Our fraud protection solutions can help you assess risk, implement controls, and build a culture of awareness.

Commerce solutions

From the USPS to military supply stores, end-to-end commerce solutions process payments seamlessly.

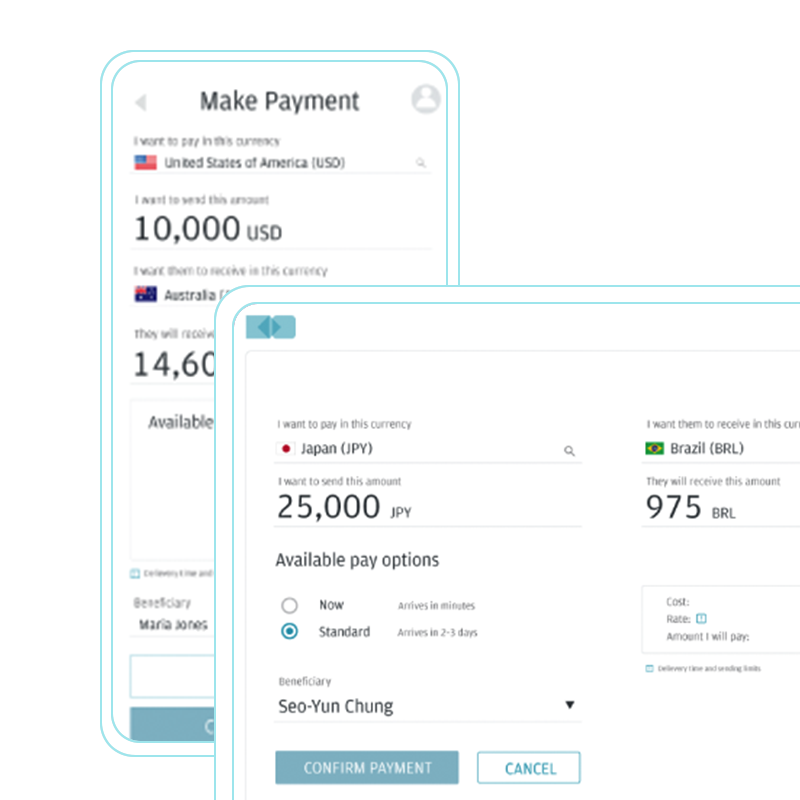

Global solutions

Whether your payments are domestic or cross-border, we have flexible & secure solutions, processing payments in over 170 countries and 120 currencies, that optimize cross-currency workflows.

Banking solutions

Customizable solutions and branches across the entire contiguous United States allow J.P. Morgan to bring a wide range of banking solutions to governments and nonprofits across the country.

Client stories

Payments

Contactless payments keep New York's MTA moving forward

Sep 10, 2021

Contactless fare payments enhance the speed, efficiency and convenience of America’s largest public transportation network.

Read moreLatest insights for the public sector

Cybersecurity

4 ways the public sector can prevent cyberattacks

Nov 14, 2022

Learn about the cybersecurity challenges facing federal, state and local agencies—and the steps every level of government can take to help prevent attacks.

Read more

Treasury

Addressing improper payments: Strategies for the public sector

Nov 01, 2021

The rise in misappropriated funds has prompted a shift in how industries in both the public and private sectors address the prevention and reduction of improper payments—aiding in successfully introducing new data mechanisms and improving user experience.

Read more

Treasury

Exploring the public sector’s new financial priorities

Aug 09, 2021

Now is the time for the public sector to unlock the value of data, accelerate digital transformation and strengthen supply chains.

Read moreGet in touch

Hide

Get in touch

Hide

References

Greenwich Associates 2021 Large Corporate Cash Management Report