From startups to legacy brands, you're making your mark. We're here to help.

-

Innovation Economy

Fueling the success of early-stage startups, venture-backed and high-growth companies.

-

Midsize Businesses

Keep your company growing with custom banking solutions for middle market businesses and specialized industries.

-

Large Corporations

Innovative banking solutions tailored to corporations and specialized industries.

-

Commercial Real Estate

Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

-

Community Impact Banking

When our communities succeed, we all succeed. Local businesses, organizations and community institutions need capital, expertise and connections to thrive.

-

International Banking

Power your business' global growth and operations at every stage.

Key Links

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

-

Asset Based Lending

Enhance your liquidity and gain the flexibility to capitalize on growth opportunities.

-

Equipment Financing

Maximize working capital with flexible equipment and technology financing.

-

Trade & Working Capital

Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives.

-

Syndicated Financing

Leverage customized loan syndication services from a dedicated resource.

-

Commercial Real Estate

Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

-

Employee Stock Ownership Plans

Plan for your business’s future—and your employees’ futures too—with objective advice and financing.

Key Links

Institutional Investing

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

-

Institutional Investors

We put our long-tenured investment teams on the line to earn the trust of institutional investors.

-

Markets

Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

-

Prime Services

Helping hedge funds, asset managers and institutional investors meet the demands of a rapidly evolving market.

-

Global Research

Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

-

Securities Services

Helping institutional investors, traditional and alternative asset and fund managers, broker dealers and equity issuers meet the demands of changing markets.

Key Links

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Center for Carbon Transition

J.P. Morgan’s center of excellence that provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future.

-

Corporate Finance Advisory

Corporate Finance Advisory (“CFA”) is a global, multi-disciplinary solutions team specializing in structured M&A and capital markets. Learn more.

-

Development Finance Institution

Financing opportunities with anticipated development impact in emerging economies.

-

Sustainable Solutions

Offering ESG-related advisory and coordinating the firm's EMEA coverage of clients in emerging green economy sectors.

-

Mergers and Acquisitions

Bespoke M&A solutions on a global scale.

-

Capital Markets

Holistic coverage across capital markets.

Key Links

A uniquely elevated private banking experience shaped around you.

-

Banking

We have extensive personal and business banking resources that are fine-tuned to your specific needs.

-

Investing

We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists.

-

Lending

We take a strategic approach to lending, working with you to craft the fight financing solutions matched to your goals.

-

Planning

No matter where you are in your life, or how complex your needs might be, we’re ready to provide a tailored approach to helping your reach your goals.

Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

-

Invest on your own

Unlimited $0 commission-free online stock, ETF and options trades with access to powerful tools to research, trade and manage your investments.

-

Work with our advisors

When you work with our advisors, you'll get a personalized financial strategy and investment portfolio built around your unique goals-backed by our industry-leading expertise.

-

Expertise for Substantial Wealth

Our Wealth Advisors & Wealth Partners leverage their experience and robust firm resources to deliver highly-personalized, comprehensive solutions across Banking, Lending, Investing, and Wealth Planning.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

This article was originally published in Commercial Banking’s magazine, Cybersecurity: Technology and Tactics.

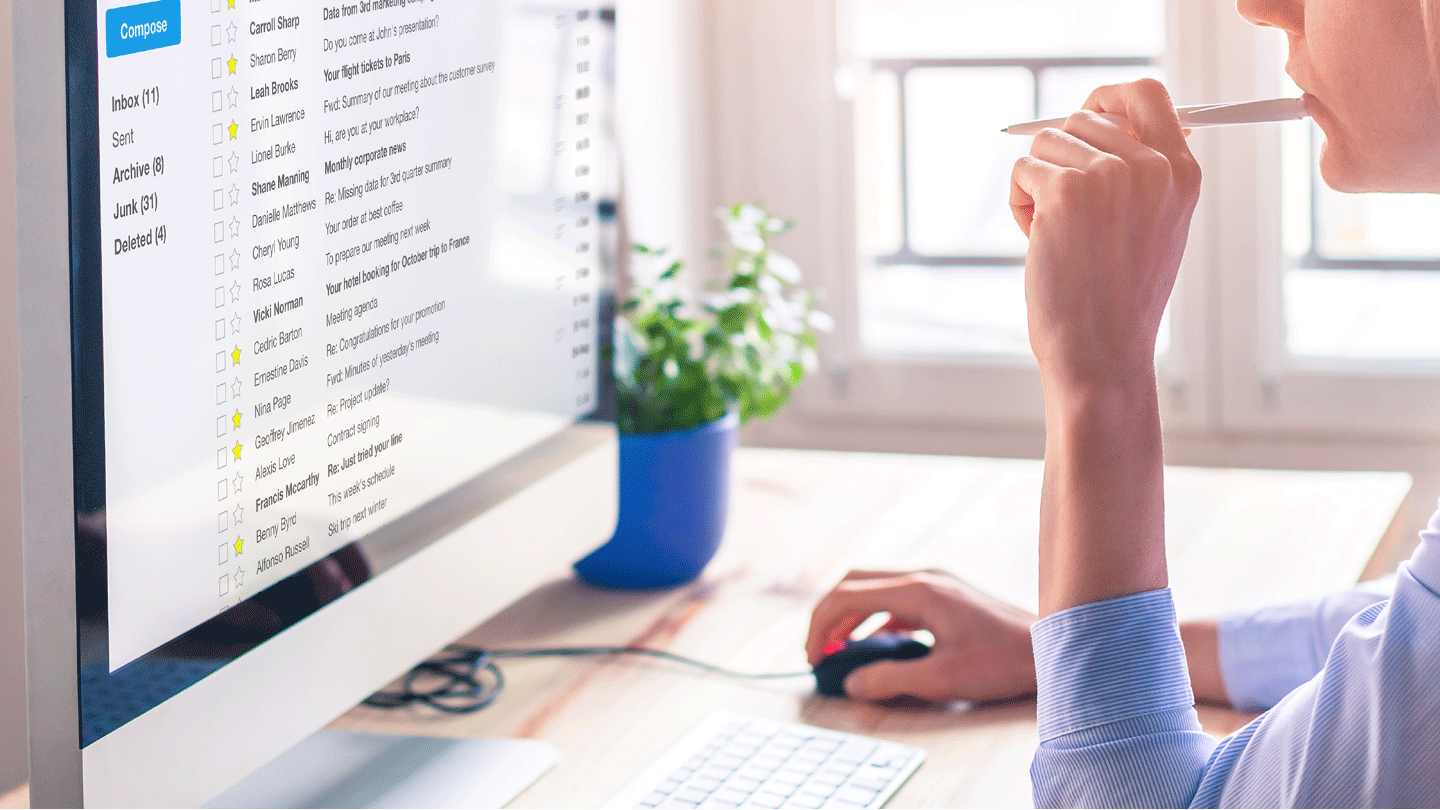

Criminals frequently impersonate chief financial officers, chief executive officers or known vendors in spoofed or compromised emails to convince employees to send money to bank accounts that the criminals control. Your company is liable for all losses incurred for payments that originate by using the security credentials of an authorized user. Unfortunately, if one of your employees releases a payment to a criminal, there’s no guarantee that you’ll be successful in recovering the funds. That’s why the callback process is such a vital step.

Developing a strong callback process reminds employees to authenticate a request before sending funds. By training employees to recognize potential schemes and validate suspicious activity—such as new bank account numbers for a known vendor—companies can often stop fraud before it’s too late.

Here are some best practices to follow:

- Always contact an email sender or trusted vendor (in person or by using a known telephone number) when you receive instructions to change bank account information. Never rely on contact information sent in an email or respond to the email request directly.

- Establish a tiered confirmation process to reduce vulnerability. For example, if an employee doesn’t perform the callback and instead asks another employee or manager to validate, they should follow a verification process to ensure protocols were followed.

- Never assume that the callback process was performed as expected—always confirm.

- Never release funds if you can’t validate the request, even if it’s marked urgent or time sensitive.

- Develop escalation protocols to use if an employee performs a callback but remains suspicious.

- Work with vendors to create shared protocols for validating email requests.

Related insights

Cybersecurity

Rise of the AI chatbots: More data. Greater danger.

May 08, 2024

Easy-to-use artificial intelligence tools may soon change our work and school lives. But they come with a host of new privacy threats. Here are some ways to help protect yourself.

Cybersecurity

How small and midsize businesses can fight fraud with limited resources

Apr 26, 2024

Small and midsize companies are just as vulnerable to schemes like business email compromise, wire fraud and insider payments fraud.

Cybersecurity

4 callback do’s and don’ts to protect against BEC

Sep 28, 2023

Callbacks are essential to rooting out payments fraud. But this validation process can still go wrong. Here’s what to do—and what not to do.

Cybersecurity

It’s back-to-school season: Are you cyber prepared?

Aug 30, 2023

With a new school year on the horizon, now is a great time to make sure your family is staying as safe as possible online.

Fraud

Report: Most companies will experience fraud

May 26, 2023

The 2023 AFP Payments Fraud and Control Report shows fraud remains a serious matter for virtually every business. Register now for our upcoming webinar to learn more about the report—and how to protect your organization.

Cybersecurity

Three cybersecurity trends to watch out for in 2023

Mar 15, 2023

Sophisticated phishing, vishing and ransomware campaigns could be aimed at a widening field of targets – but there are things you can do to protect yourself.

Cybersecurity

How to protect against wire fraud in multifamily real estate

Feb 08, 2023

Wire fraud affects thousands of businesses each year. These tips can help protect commercial real estate investors from being scammed.

Cybersecurity

Your all-in-one guide to business email compromise

Jan 17, 2023

Protecting against BEC requires a comprehensive strategy. Use these tips and best practices to help strengthen your organization’s defenses against one of the most pervasive methods of fraud.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.